Newsroom

Pirate Gold Continues Its Regional Consolidation of the Treasure Island Project and Provides Drilling Update

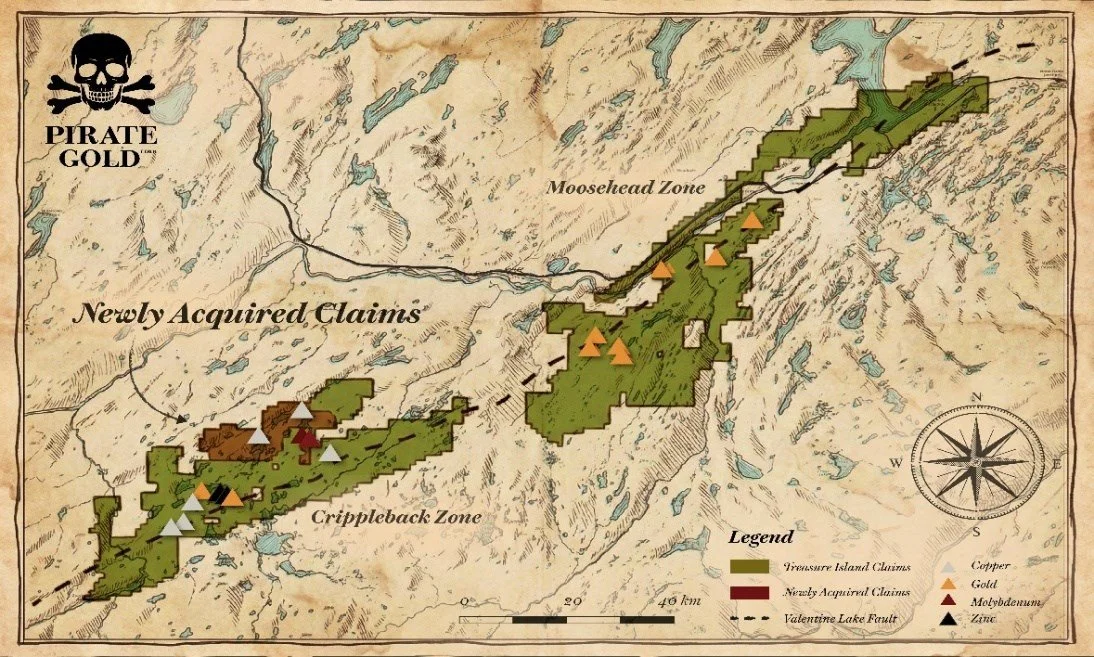

Expanded Treasure Island to over 90km of strike length through the acquisition of 113 additional mineral claims along the Valentine Lake Fault Zone

Advanced the 50,000m drill program with two active rigs, early visual mineralization at Moosehead, and initial testing of regional geophysical targets

Episode 2 of Pirate Gold Treasure Hunters now airing: https://youtu.be/JCqFsiE_9Eo

St. John's, Newfoundland and Labrador--(Newsfile Corp. - December 19, 2025) - Pirate Gold Corp. (TSXV: YARR) (OTCQB: SICNF) ("Pirate Gold" or the "Company") is pleased to announce that it has added an additional 113 mineral claims to its wholly owned Treasure Island Project in central Newfoundland. The Treasure Island Project now covers over 90km of strike along the Valentine Lake Fault Zone in Canada's newest gold district.

Drilling Program Update

Two diamond drills are currently active at the Treasure Island Project with a third drill anticipated to mobilize in early 2026

One drill is focused on the expansion of the Moosehead Eastern and Western trends and has completed six holes to date

The second drill rig is conducting regional exploration drilling localized within several kilometres of the Moosehead Zone and has completed two holes to date

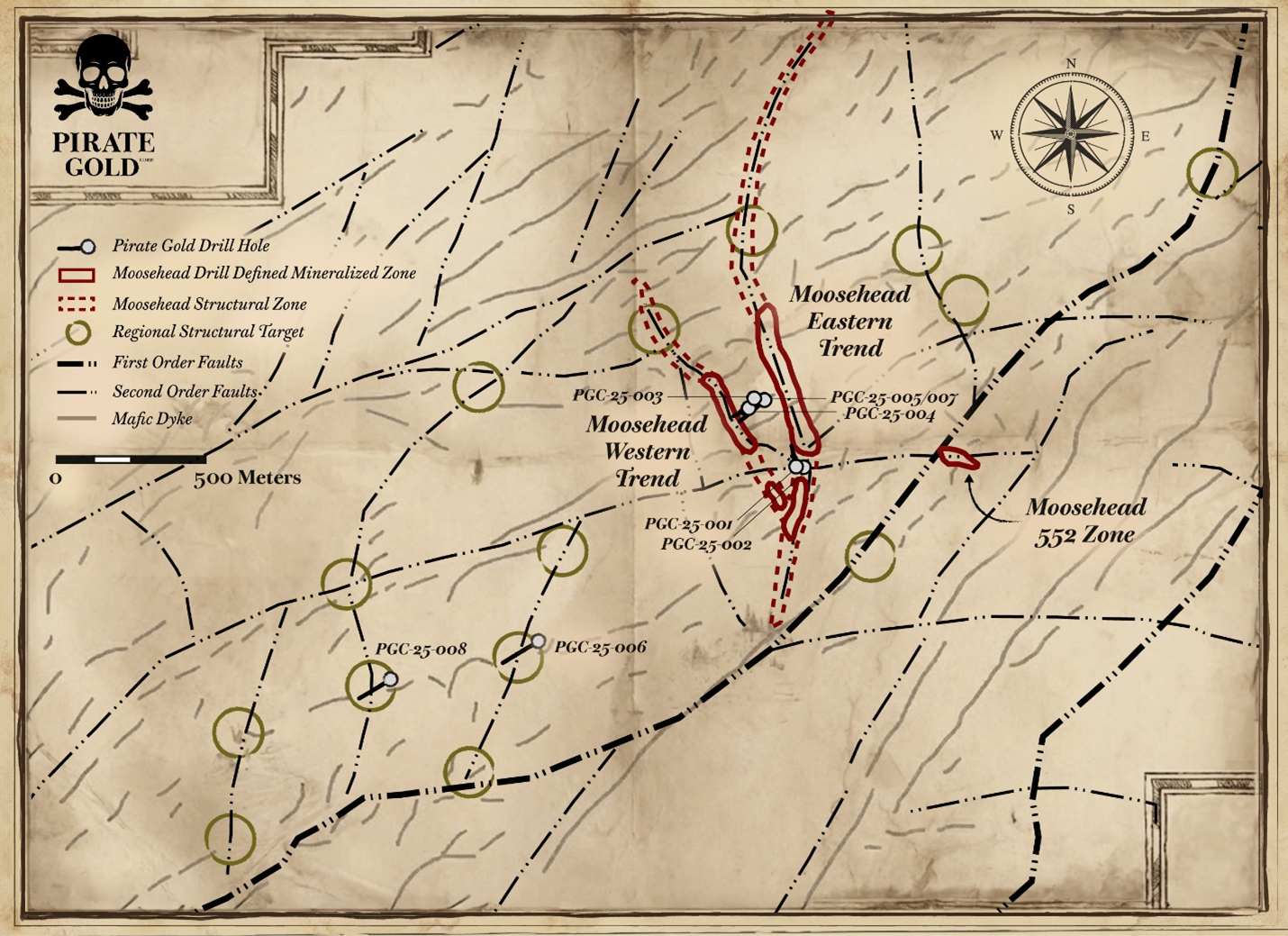

Initial visual observations from completed drill holes are summarized below:

Table 1 – Visual Observations of Drill Core from Hole PGC-25-001 through PGC-25-008

The Company cautions that the presence of visible gold mineralization is not indicative of high gold assay grades and that drill core samples will or have been submitted to a certified laboratory for analysis of gold content. Assay values for the discussed intervals will be released when available. All intervals are downhole depths, and true widths are not known at this time.

Table 2 – Drill Hole Information for PGC-25-001 through PGC-25-008

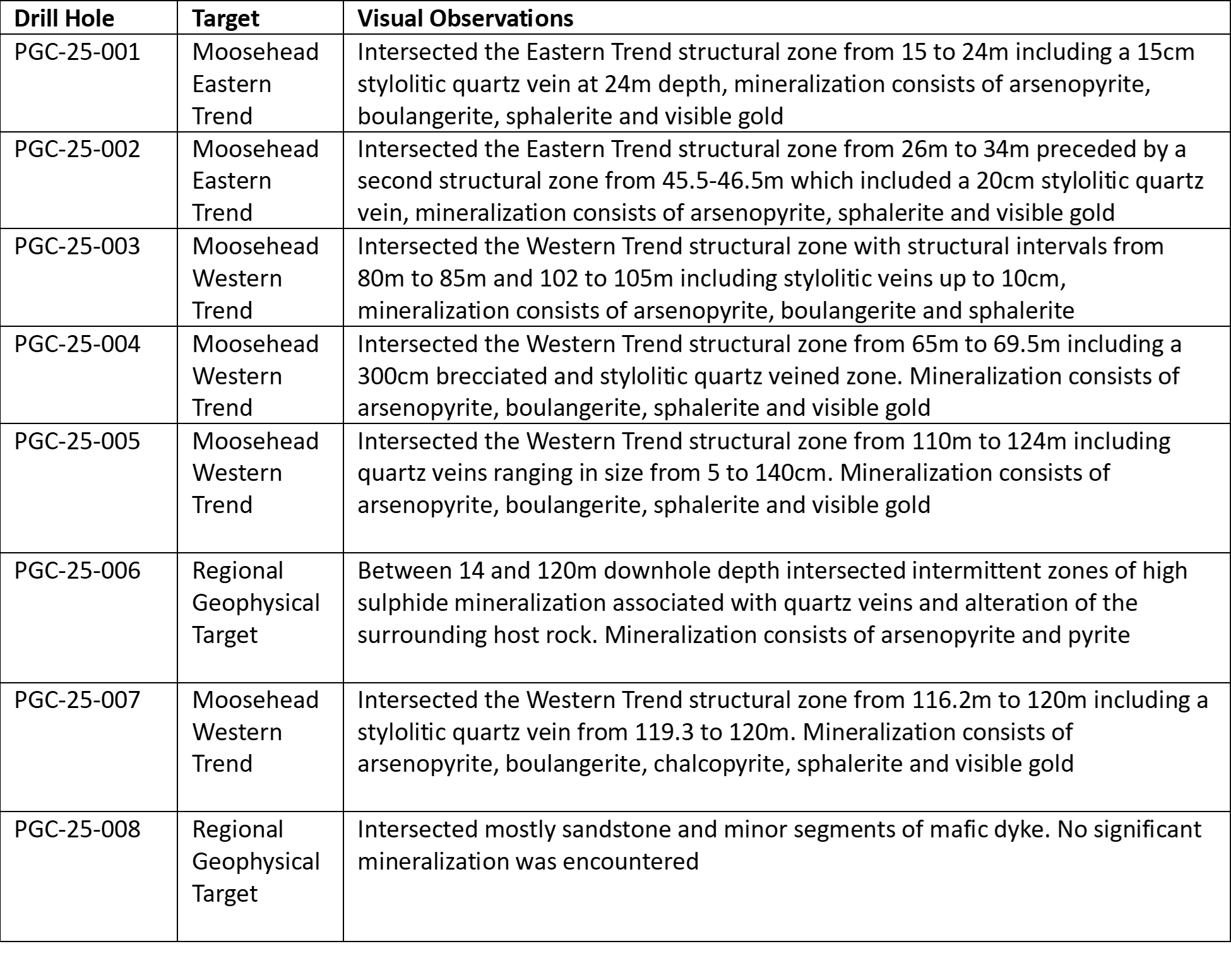

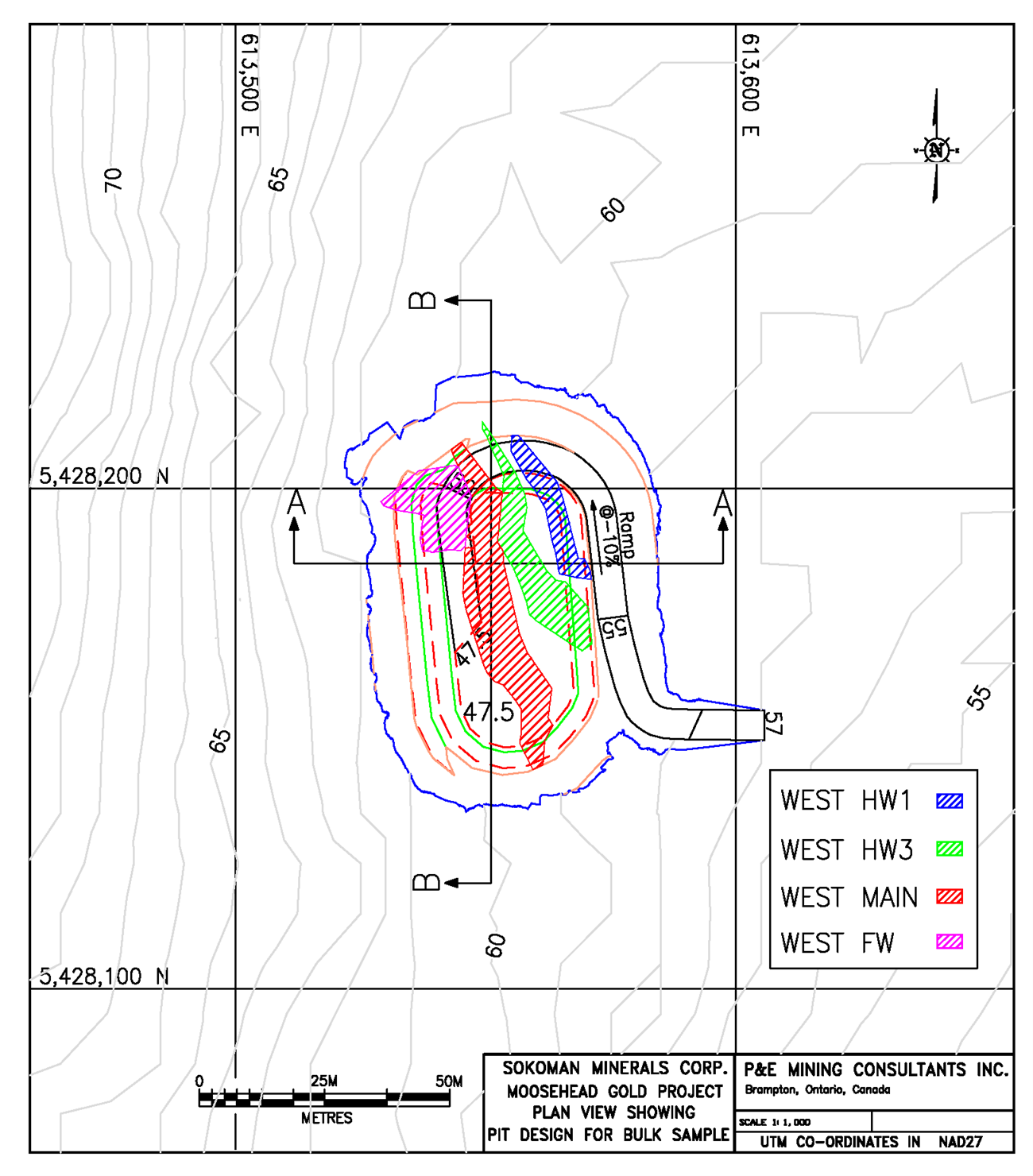

Fig. 1 - Map Showing the Moosehead Mineralized Zones, Structural Corridor, Interpreted Faults and Regional Structural Drill Targets

Pirate Gold Treasure Hunters - Episode 2: Drilling Underway at Treasure Island

Episode 2 of Pirate Gold Treasure Hunters provides shareholders with a behind-the-scenes look at the early stages of the drilling campaign and features:

Visual updates from the first drill holes at Moosehead

Initial drilling insights from regional geophysical targets

An overview of the expanding exploration team and regional strategy

Viewers are encouraged to join the hunt by subscribing to the Pirate Gold YouTube channel: https://www.youtube.com/@PirateGoldCorp

Drill Core Featured in the Pirate Gold Treasure Hunters Video Series

Fig. 2 – Image of Drill core from PGC-25-005 Showing Veined Zone in the Moosehead Western Trend

Fig. 3 – Image of Drill core from PGC-25-006 Showing Segment of the Veined Zone at the Regional Target

Fig. 4 – Image of Drill core from PGC-25-007 Showing Veined Zone in the Moosehead Western Trend

Mineral Claims Addition

Three separate mineral license purchase agreements have been executed to acquire 77 mineral claims covering 1,925 hectares

Recent staking has added an additional 36 mineral claims covering 900 hectares

“The consolidation of a fragmented mineral tenure along the Valentine Lake Fault corridor has been one the key first steps for the company to build value in this district. Starting with its advanced-stage Moosehead Project the company has grown its exploration focus to cover over 90km of strike length along the prospective fault corridor. Today’s announcement continues to build that regional scale project.”

“The initial focus of our 50,000m drilling program has been to explore both within and around the immediate vicinity of the Moosehead Zone looking for other similar gold bearing structures. Our exploration ethos has been that Moosehead shouldn’t be a singular high-grade structure and that it fits into a larger mineral system as seen in other orogenic gold deposits. Our acquisition of the Stony Lake project south of Moosehead in October includes historical drilling results up to *1.88g/t Au over 27.35m and 1.52g/t over 31.75m located just 5 km south of the Moosehead fault structure which indicates there is much more to learn about the gold mineralization in this part of the Treasure Island Project.” said Greg Matheson, VP Exploration of Pirate Gold.

* The Qualified Person has not done sufficient work to verify the drilling results published by K9 Gold Corp. K9 Gold Corp, Oct 18, 2022, K9 Gold Confirms Continuity of Gold Mineralization; Intersects 1.52g/t Gold over 31.75m at Stony Lake. https://www.sedarplus.ca/csa-party/records/document.html?id=160f518a52577fa127426f087fcb5548cc5b2a969a3e5ee1213bc90d5797c71f

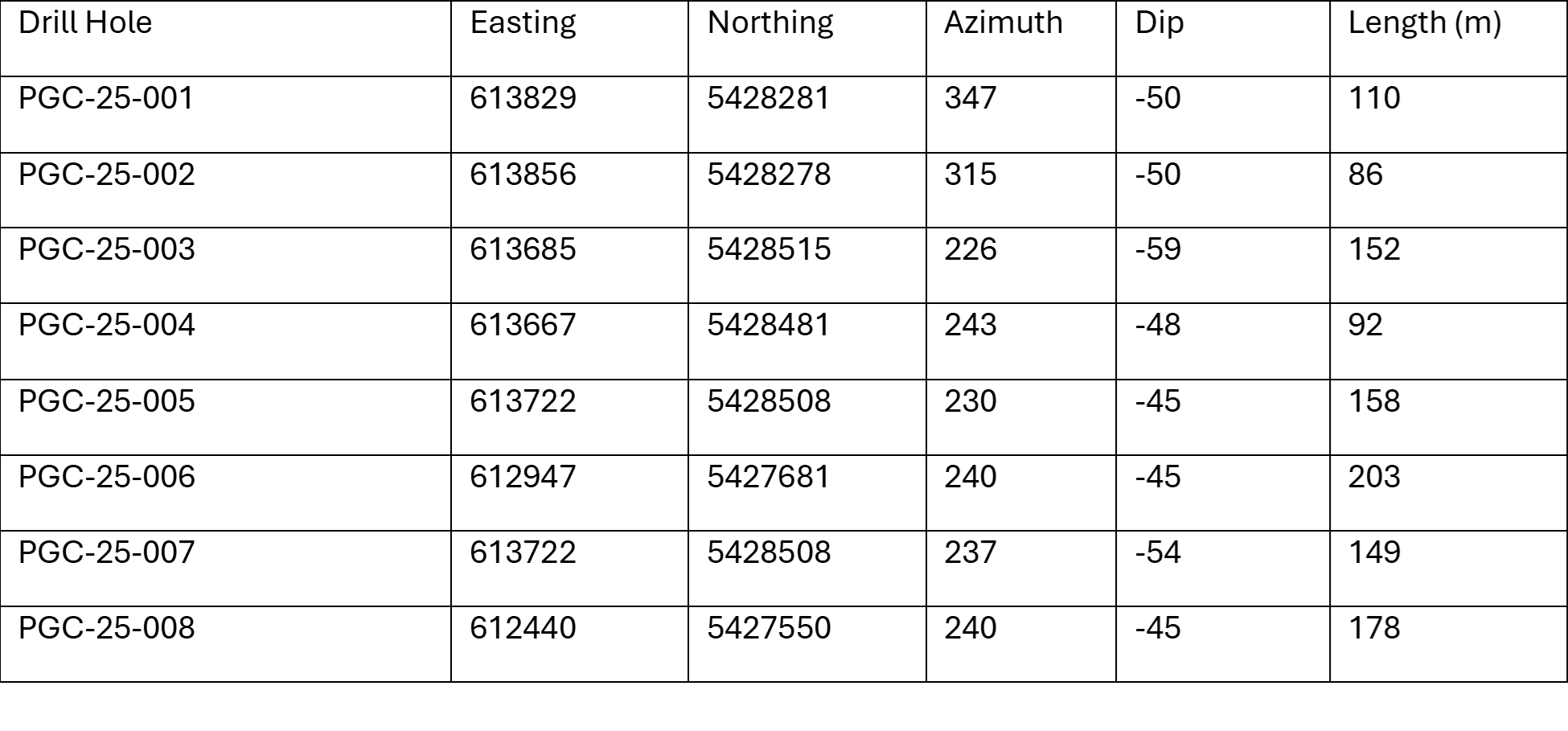

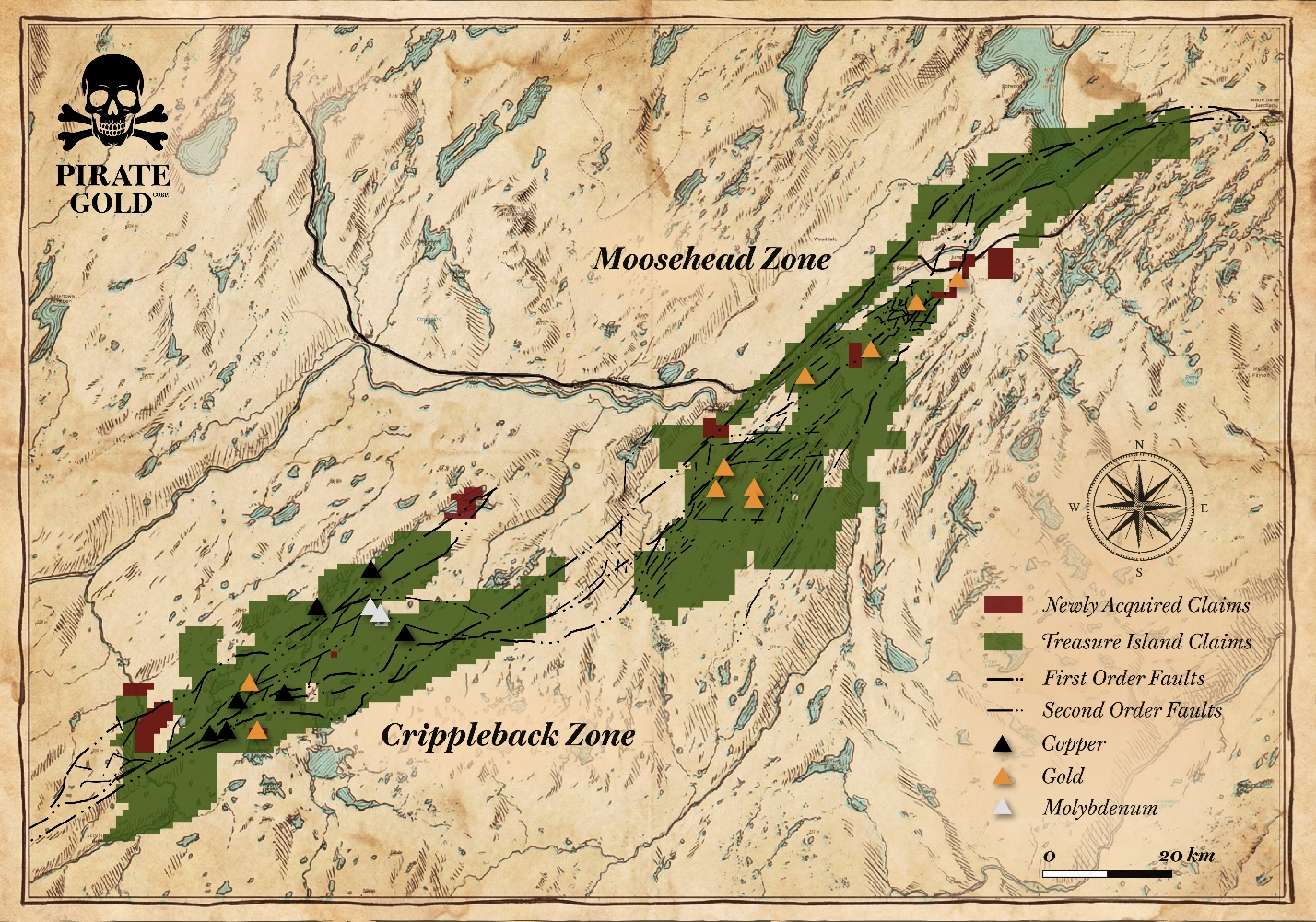

Fig. 5 - Map Showing the Consolidated Mineral Licenses and Newly Acquired Claims of the Treasure Island Project

Pirate Gold has entered into an agreement with Paradigm Minerals, Ian Farrell (“Farrell”), Rebecca Heathcote (“Heathcote”) and Katie Lewis (“Lewis”) to acquire a 100% interest in and to four mineral licences. In consideration the Company will, subject to TSX Venture Exchange ("TSXV") approval, make a one-time cash payment of $400 to Farrell, $2,000 to Heathcote, $9,960 to Lewis and issue 20,000 common shares to Farrell, 50,000 common shares to Heathcote, 230,000 common shares to Lewis, and grant a 1.5% NSR royalty to Lewis, one half of which Pirate Gold can purchase for $1,000,000.

The Company has also entered in an agreement with Kevin Keats and 91112 Newfoundland and Labrador Inc. ("91112") to acquire a 100% interest in and to one mineral license. In consideration the Company will, subject to TSXV approval, make a one-time cash payment of $10,000 and issue 250,000 common shares, and grant a 1.0% NSR royalty, one half of which Pirate Gold can purchase for $1,000,000.

The Company has entered in an agreement with Brian Jones (“Jones”) and Gary Rowsell ("Rowsell") to acquire a 100% interest in and to one mineral license. In consideration the Company will, subject to TSXV approval, make a one-time cash payment of $2,500 to Jones, $2,500 to Rowsell and issue 50,000 common shares to Jones, 50,000 common shares to Rowsell, and grant a 1.0% NSR royalty allocated 50% to Jones and 50% to Rowsell, one half of which Pirate Gold can purchase for $1,000,000.

Qualified Person

Greg Matheson, P.Geo., VP Exploration for Pirate Gold, a "Qualified Person" under National Instrument 43-101, has reviewed and approved the scientific and technical information in this press release.

About Pirate Gold Corp.

Pirate Gold Corp. (TSXV: YARR) (OTCQB: SICNF) is led by an experienced management team and is the dominant explorer along the Valentine Lake Fault Zone in Newfoundland, Canada's newest gold district. The Company's primary focus is its 100% owned district-scale Treasure Island Gold Project, along with a portfolio of gold projects, including the district-scale Fleur de Lys Project.

For more information, please contact:

Denis Laviolette, Executive Chairman, CEO & Director

E: denis@pirategold.ca

Cathy Hume, VP Corporate Development & Director

T: 416-868-1079 x 251

E: cathy@chfir.com

Website: www.pirategold.ca

YouTube: @PirateGoldCorp

Twitter: @PirateGoldCorp

Facebook: @PirateGoldCorp

LinkedIn: @PirateGoldCorp

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Company should be considered highly speculative. This news release contains "forward-looking statements" within the meaning of the applicable Canadian securities legislation that are based on expectations, estimates, assumptions, geological theories, and projections as at the date of this news release. The information in this news release about any information herein that is not a historical fact may be "forward-looking statements." Actual results may differ materially. Any statement that involves discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (which may, but not always, include phrases such as "anticipates", "plans", "scheduled", "believed" or "intends" or variations of such words and phrases or stating that certain actions, events or results "may" or "could", "would", "might" or "will" be taken to occur or be achieved) including statements regarding the Company's plans with respect to the Company's projects and the timing related thereto, the merits of the Company's projects, the Company's objectives, plans and strategies, and other matters are not statements of historical fact and may be forward-looking statements and are intended to identify forward-looking statements. Factors that may cause results to vary include delays in obtaining necessary approvals, changes in the market for the Company's securities, results of exploration, loss of title to properties, delays in obtaining permits or access to mineral properties, including as a result of adverse weather, fire or flood, changes to the Tax Act, rejection of expenditures as Qualifying Expenditures, and factors included in the documents filed from time to time with the Canadian securities regulatory authorities by Pirate Gold Corp. Pirate Gold Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof, except as required by law.

Pirate Gold Appoints World-Renowned Orogenic Gold Expert Dr. Richard J. Goldfarb as Strategic Advisor and Releases Season 1, Episode 1 of Pirate Gold Treasure Hunters

Appointment of Dr. Richard J. Goldfarb, one of the world’s foremost orogenic gold experts, to strengthen targeting and district-scale modelling at Treasure Island

Episode 1 of Pirate Gold Treasure Hunters now airing, gives a behind-the-scenes look at the first site visit and the exploration story as it unfolds in real time (https://www.youtube.com/watch?v=R0qMbpudpF0)

St. John's, Newfoundland and Labrador--(Newsfile Corp. – December 9, 2025) – Pirate Gold Corp. (TSXV: YARR) (OTCQB: SICNF) (“Pirate Gold” or the “Company”), is pleased to announce the appointment of Dr. Richard J. Goldfarb as Strategic Advisor. Dr. Goldfarb is one of the world’s leading authorities on orogenic gold deposits and brings unmatched expertise to the Company as it advances exploration at its Treasure Island Project along the Valentine Lake Fault Zone.

Dr. Goldfarb spent 36 years as a senior research geologist with the United States Geological Survey and has authored more than 350 scientific publications that define the global understanding of orogenic gold systems. He has delivered more than 350 invited talks across 40 countries, has over 25,000 citations, and has received the most prestigious honours in the field of economic geology including the Society of Economic Geologist’s Silver and Penrose Gold Medals, as well as the Society for Geology Applied to Mineral Deposits (SGA) Newmont Gold Medal.

His advisory roles span work with numerous major and junior gold producers and explorers, as well as with governments. He currently serves as a Research Professor at the Colorado School of Mines and the China University of Geosciences in Beijing.

“Orogenic systems are responsible for many of the world’s largest and most continuous gold deposits,” said Dr. Goldfarb. “Treasure Island sits in a highly prospective accretionary belt with the right structures, the right chemistry, and the right scale. The opportunity here is significant and I look forward to supporting the team as they develop this emerging district.”

“Having Dr. Goldfarb join Pirate Gold as a strategic advisor is a major milestone,” said Denis Laviolette, Executive Chairman and CEO. “His work shaped the global exploration playbook for orogenic gold. Treasure Island is exactly the type of system where his expertise becomes a real differentiator. This strengthens every step of our technical approach.”

Pirate Gold Treasure Hunters Season 1, Episode 1 Now Airing: Join the Hunt at Treasure Island

Pirate Gold has released Season 1, Episode 1 of Pirate Gold Treasure Hunters, the Company’s new documentary-style video series that brings viewers directly into the search for discovery at Treasure Island.

Episode 1 takes viewers on the first full site visit with Denis Laviolette, Greg Matheson, and Timothy Froude as they open the season’s exploration storyline. The episode features behind-the-scenes footage, in-field walkthroughs, the geological clues driving the drill plan, and the early structures that have shaped the emerging district-scale model.

Pirate Gold Treasure Hunters follows the team in real time as they chase new targets, interpret fresh core, and uncover the signals of a potential orogenic system along the Valentine Lake Fault Zone.

“This project has scale, and we want people to feel like they’re right there with us as the clues build,” added Laviolette. “Treasure hunting is in the DNA of this company. The series shows what happens when a technical team goes after a system of this size. Episode 1 is just the start of the story.”

Viewers are encouraged to join the hunt by subscribing to the Pirate Gold YouTube channel: https://www.youtube.com/@PirateGoldCorp

Further, Pirate Gold has granted 250,000 stock options to a consultant of the Company. The options shall vest immediately and are exercisable at $0.25 per common share for a period of five (5) years.

About Pirate Gold Corp.

Pirate Gold Corp. is led by an experienced management team and is the dominant explorer along the Valentine Lake Fault zone in Newfoundland, Canada's newest gold district. The Company's primary focus is its 100% owned district-scale Treasure Island Gold Project, along with a portfolio of gold projects, including the district-scale Fleur de Lys Project.

For more information, please contact:

Denis Laviolette, Executive Chairman, CEO & Director

E: denis@pirategold.ca

Cathy Hume, VP Corporate Development & Director

T: 416-868-1079 x 251

E: cathy@chfir.com

Website: www.pirategold.ca

YouTube: @PirateGoldCorp

Twitter: @PirateGoldCorp

Facebook: @PirateGoldCorp

LinkedIn: @PirateGoldCorp

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Company should be considered highly speculative. This news release contains "forward-looking statements" within the meaning of the applicable Canadian securities legislation that are based on expectations, estimates, assumptions, geological theories, and projections as at the date of this news release. The information in this news release about any information herein that is not a historical fact may be "forward-looking statements." Actual results may differ materially. Any statement that involves discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (which may, but not always, include phrases such as "anticipates", "plans", "scheduled", "believed" or "intends" or variations of such words and phrases or stating that certain actions, events or results "may" or "could", "would", "might" or "will" be taken to occur or be achieved) including statements regarding the Company's plans with respect to the Company's projects and the timing related thereto, the merits of the Company's projects, the Company's objectives, plans and strategies, and other matters are not statements of historical fact and may be forward-looking statements and are intended to identify forward-looking statements. Factors that may cause results to vary include delays in obtaining necessary approvals, changes in the market for the Company's securities, results of exploration, loss of title to properties, delays in obtaining permits or access to mineral properties, including as a result of adverse weather, fire or flood, changes to the Tax Act, rejection of expenditures as Qualifying Expenditures, and factors included in the documents filed from time to time with the Canadian securities regulatory authorities by Pirate Gold Corp. Pirate Gold Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof, except as required by law.

Pirate Gold Initiates 50,000 m Drilling Program and Launches New Video Series at Its Treasure Island Project

Two rigs active and a third mobilizing in early 2026 for a 50,000 m campaign designed to expand high-grade zones and test new regional structure

New shareholder video series will bring investors inside the hunt (https://www.youtube.com/watch?v=Hcjxi92GphY) - teaser video released today

St. John's, Newfoundland and Labrador--(Newsfile Corp. – December 4, 2025) – Pirate Gold Corp. (TSXV: YARR) (OTCQB: SICNF) (“Pirate Gold” or the “Company”), is pleased to announce that it has initiated a 50,000 metre diamond drilling program at its wholly owned Treasure Island Project in central Newfoundland. The Treasure Island Project covers over 80 km of strike along the Valentine Lake fault zone in Canada’s newest gold district.

Highlights

Drilling has commenced at Treasure Island with two diamond drills on site and a third rig scheduled to mobilize in early 2026

The program is expected to run throughout 2026

Initial focus of the drilling program will be on the expansion of known zones at high grade Moosehead zone with a primary focus on new regional discoveries throughout the district scale project

“We recognized early on in our assessment of Treasure Island that discoveries here are going to be made with the drill bit,” said Greg Matheson, VP Exploration of Pirate Gold. “With the amalgamation of a number of prospects across a vast area of favourable geology we have a truly regional scale project on our hands with potential to host a number of mineral systems.

Our team is rapidly moving targets through our exploration pipeline to the drilling stage and embarking on an ambitious drilling program will allow us to explore both the developed prospects and grass roots targets at a rapid pace.”

New Video Series: Join the Hunt at Treasure Island

Pirate Gold is launching a new corporate video series, starting with a teaser video released today, designed to bring shareholders directly into the exploration process as it unfolds.

The series will walk investors through the real work behind discovery; how targets are generated, why structures along the Valentine Lake Fault Zone matter, what early drill core reveals, and how the team is advancing a truly regional-scale opportunity. The aim is to help investors clearly understand what we’re doing, why it matters, and how each result builds the bigger picture.

The full series will feature:

On-site drilling updates and core reviews

Geological and structural walkthroughs

Prospect-level fieldwork and technical progress

Commentary from the exploration team on how each step refines the model

“Our exploration model at Treasure Island is built on scale. Scale of geology, scale of opportunity, and now scale of communication,” said Denis Laviolette, Executive Chairman and CEO. “We want shareholders to feel like they’re on the ground with us. This series brings them into the hunt, showing exactly how each hole, each structure, and each decision fits into the larger story we’re chasing.”

Viewers are encouraged to join the hunt by subscribing to the Pirate Gold YouTube channel: https://www.youtube.com/@PirateGoldCorp

About Pirate Gold Corp.

Pirate Gold Corp. is led by an experienced management team and is the dominant explorer along the Valentine Lake Fault zone in Newfoundland, Canada's newest gold district. The Company's primary focus is its 100% owned district-scale Treasure Island Gold Project, along with a portfolio of gold projects, including the district-scale Fleur de Lys Project.

For more information, please contact:

Denis Laviolette, Executive Chairman, CEO & Director

E: denis@pirategold.ca

Cathy Hume, VP Corporate Development & Director

T: 416-868-1079 x 251

E: cathy@chfir.com

Website: www.pirategold.ca

YouTube: @PirateGoldCorp

Twitter: @PirateGoldCorp

Facebook: @PirateGoldCorp

LinkedIn: @PirateGoldCorp

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Company should be considered highly speculative. This news release contains "forward-looking statements" within the meaning of the applicable Canadian securities legislation that are based on expectations, estimates, assumptions, geological theories, and projections as at the date of this news release. The information in this news release about any information herein that is not a historical fact may be "forward-looking statements." Actual results may differ materially. Any statement that involves discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (which may, but not always, include phrases such as "anticipates", "plans", "scheduled", "believed" or "intends" or variations of such words and phrases or stating that certain actions, events or results "may" or "could", "would", "might" or "will" be taken to occur or be achieved) including statements regarding the Company's plans with respect to the Company's projects and the timing related thereto, the merits of the Company's projects, the Company's objectives, plans and strategies, the receipt of TSXV final approval for the Offering, the use of proceeds of the Offering, and other matters are not statements of historical fact and may be forward-looking statements and are intended to identify forward-looking statements. Factors that may cause results to vary include delays in obtaining necessary approvals, changes in the market for the Company's securities, results of exploration, loss of title to properties, delays in obtaining permits or access to mineral

properties, including as a result of adverse weather, fire or flood, changes to the Tax Act, rejection of expenditures as Qualifying Expenditures, and factors included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof, except as required by law.

Not for distribution to United States newswire services or for dissemination in the United States.

Pirate Gold Corp. (Formerly Sokoman Minerals) Announces Commencement of Trading Under New Symbol “YARR”

• Common shares now trading as Pirate Gold Corp. (“YARR”) on the TSX Venture Exchange and (“SICNF”) on the OTCQB Venture Market.

St. John's, Newfoundland and Labrador--(Newsfile Corp. – December 1, 2025) – Pirate Gold Corp. (TSXV: YARR) (OTCQB: SICNF) (“Pirate Gold” or the “Company”), formerly Sokoman Minerals Corp., is pleased to announce that its common shares have commenced trading on the TSX Venture Exchange under the new ticker symbol YARR, effective today. Pirate Gold's common shares will continue to trade on the OTCQB Venture Market under the ticker SICNF.

The name and symbol change unify the Company’s identity under the Pirate Gold banner, reflecting a renewed focus on discovery, value creation, and the frontier spirit rooted in Newfoundland’s exploration history.

No Action Required by Shareholders

The CUSIP/ISIN 724255104/CA7242551041 and CUSIP/ISIN 724255203/CA7242552031 numbers for the Company’s common shares have been updated in connection with the transition. Shareholders are not required to take any action, as all changes will occur automatically through the Company’s transfer agent and through each shareholder’s respective brokerage.

The Company will be launching a new website at www.pirategold.ca, along with an updated corporate presentation and new corporate videos, in the coming weeks. Until then, investors can continue to access information through the Company’s existing website, as well as its updated social media channels on LinkedIn, X, and Facebook under @PirateGoldCorp.

“Today we set sail as Pirate Gold,” said Denis Laviolette, Chairman and CEO of Pirate Gold. “Our team is focused on driving value at the Treasure Island Project, and the new name reflects a shift toward tighter execution, sharper targets, and a disciplined approach to building value. We have a full runway ahead and new tools coming online. Investors know the real upside comes from the hunt, and we’re charting our next course with purpose. This is where the story starts to get exciting.”

About Pirate Gold Corp.

Pirate Gold Corp. is led by an experienced management team and is the dominant explorer along the Valentine Lake Fault zone in Newfoundland, Canada's newest gold district.

The Company's primary focus is its 100% owned district-scale Treasure Island Gold Project, along with a portfolio of gold projects, including the district-scale Fleur de Lys Project.

For more information, please contact:

Denis Laviolette, Executive Chairman, CEO & Director

E: denis@pirategold.ca

Cathy Hume, VP Corporate Development & Director

T: 416-868-1079 x 251

E: cathy@chfir.com

Website: www.pirategold.ca

Twitter: @PirateGoldCorp

Facebook: @PirateGoldCorp

LinkedIn: @PirateGoldCorp

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Company should be considered highly speculative. This news release contains "forward-looking statements" within the meaning of the applicable Canadian securities legislation that are based on expectations, estimates, assumptions, geological theories, and projections as at the date of this news release. The information in this news release about any information herein that is not a historical fact may be "forward-looking statements." Actual results may differ materially. Any statement that involves discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (which may, but not always, include phrases such as "anticipates", "plans", "scheduled", "believed" or "intends" or variations of such words and phrases or stating that certain actions, events or results "may" or "could", "would", "might" or "will" be taken to occur or be achieved) including statements regarding the Company's plans with respect to the Company's projects and the timing related thereto, the merits of the Company's projects, the Company's objectives, plans and strategies, the receipt of TSXV final approval for the Offering, the use of proceeds of the Offering, and other matters are not statements of historical fact and may be forward-looking statements and are intended to identify forward-looking statements. Factors that may cause results to vary include delays in obtaining necessary approvals, changes in the market for the Company's securities, results of exploration, loss of title to properties, delays in obtaining permits or access to mineral properties, including as a result of adverse weather, fire or flood, changes to the Tax Act, rejection of expenditures as Qualifying Expenditures, and factors included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof, except as required by law.

Not for distribution to United States newswire services or for dissemination in the United States.

Sokoman Minerals Corp. Announces Name Change to Pirate Gold Corp., Expands Land Position at the Treasure Island Project

Rebrand to Pirate Gold reflects both the geological opportunity beneath Newfoundland's surface and the spirit of treasure hunting and discovery that shaped its earliest legends

Treasure Island Project expansion adds 4,625 hectares of highly prospective ground along the Valentine Lake Fault, strengthening Sokoman's district-scale position

St. John's, Newfoundland and Labrador - November 25, 2025 - Sokoman Minerals Corp. (TSXV: SIC) (OTCQB: SICNF) ("Sokoman" or the "Company") is pleased to announce that it has received approval from the TSX Venture Exchange ("TSXV" or the "Exchange") to change its name to Pirate Gold Corp. ("Pirate Gold"). Effective December 1, 2025, the Company will commence trading under its new name and new stock symbol, YARR. CUSIP/ISIN 724255104/CA7242551041 and CUSIP/ISIN 724255203/CA7242552031 have been assigned to the Company's common shares.

Pirate Gold's common shares will continue to trade on the OTCQB Venture Market under the ticker SICNF.

Newfoundland's coastline is steeped in pirate history. In the early 1600s, its hidden coves were home to one of the Atlantic's most powerful pirate fleets. This legacy of risk-taking and the relentless pursuit of untapped fortune aligns directly with the Company's exploration approach.

"Newfoundland was built on a frontier mindset; hard weather, harder rock, and people who carved out a living where most wouldn't dare," said Denis Laviolette, Chairman and CEO of Sokoman. "That same instinct drives modern exploration. Junior mining is treasure hunting, and just like the pirates who came here 400 years ago chasing fortune, we're doing the same today at our district-scale Treasure Island Project with a team that knows these rocks.

"Over the past few months, we've reinforced the existing team with geologists and technical staff, more than doubling our technical and operational bench. We now have a deep pool of experience in orogenic systems, and it's reshaping how this company operates. That shift will be on full display as we bring shareholders directly into the hunt through new videos, on-the-ground visuals, and a recurring documentary series that captures the story as it unfolds."

Sokoman Expands Land Position at the Treasure Island Project

Sokoman is also pleased to report a significant expansion of its Treasure Island Project in Newfoundland. The Company has entered into two purchase agreements to acquire additional mineral licenses contiguous to its existing holdings, strengthening its position along one of the region's most prospective structural trends.

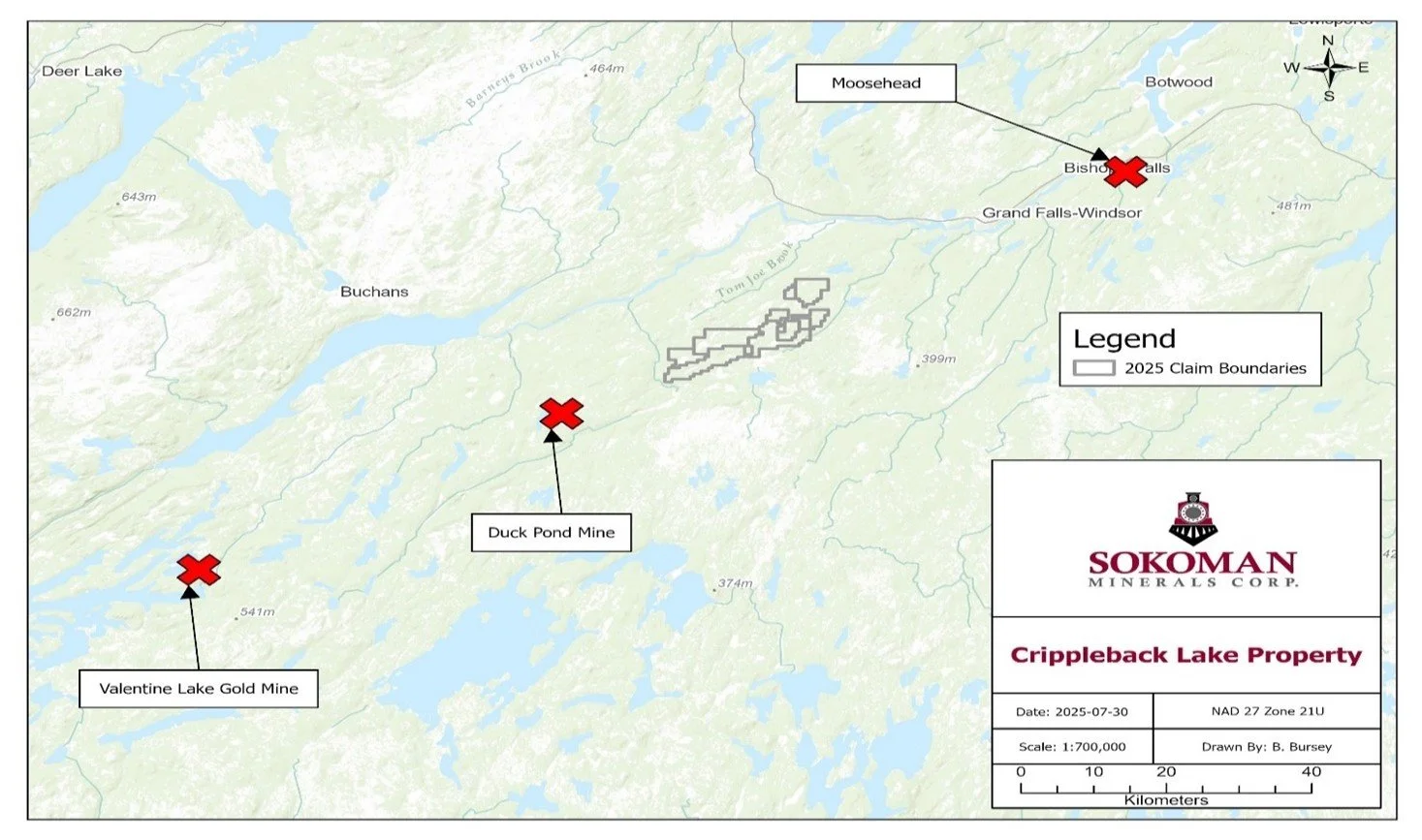

As noted on October 8, 2025, the Company transformed its Moosehead and Crippleback claim groups to form the Treasure Island Project. The Treasure Island Project contains the largest mineral license package and longest strike length along the Valentine Lake Fault and positions the Company as the dominant explorer along strike of the Valentine Gold Mine.

The newly acquired claims increase the Treasure Island project footprint by approximately 4,625 hectares and include multiple untested geophysical and geochemical anomalies, along with favourable stratigraphy identified through both historical work and recent compilation.

This expansion builds on the Company's broader consolidation strategy across the central Newfoundland gold belt and positions the Company to evaluate several high-priority target areas with improved geological context.

"We've acquired a few new mineral licenses on Treasure Island, expanding our position and pushing deeper into ground that's barely been tested," added Laviolette. "These new claims stitch together important structural corridors and give us the ability to evaluate targets with far better geological continuity. It's the kind of ground you want when you're chasing an orogenic system - connected, underexplored, and sitting exactly where the structure tells you to look."

Fig. 1 - Map Showing the Consolidated Mineral Licenses and Newly

Acquired Claims of the Treasure Island Project

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6079/275821_3f27cfc834ddb9ff_002full.jpg

Sokoman has entered into an agreement with Fred Keats ("Keats"), Darryl Williams ("Williams"), Donna Gedge, Calvin Keats, and Leo Hussey to acquire a 100% interest in and to seven mineral licences (the "Aurora Project"). In consideration for the Aurora Project, the Company will, subject to TSXV approval, make a one-time cash payment of $37,500 to Keats and $12,500 to Williams, issue 600,000 common shares to Keats and 200,000 common shares to Williams, and grant a 1.5% NSR royalty, payable 75% to Keats and 25% to Williams, one-half of which the Company may purchase for $1,500,000.

Sokoman has also entered into an agreement with Neal Blackmore ("Blackmore") to acquire a 100% interest in and to one mineral licence. In consideration, subject to TSXV approval, the Company will make a one-time cash payment of $10,000, issue 100,000 common shares, and grant a 1.0% NSR royalty, one-half of which the Company may purchase for $500,000.

Further, Sokoman has granted 21,100,000 stock options to the Company's officers, directors, and consultants. The options shall vest immediately and are exercisable at $0.25 per common share for a period of five (5) years. As the Company scales its exploration efforts, these grants provide operational alignment and ensure key personnel are appropriately incentivized to support and advance ongoing exploration activities.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is led by an experienced management team and is the dominant explorer along the Valentine Lake Fault zone in Newfoundland, Canada's newest gold district. The Company's primary focus is its 100% owned district-scale Treasure Island Gold Project, along with a portfolio of gold projects, including the district-scale Fleur de Lys Project.

For more information, please contact:

Denis Laviolette, Executive Chairman, CEO & Director

E: denis@sokomanmineralscorp.com

Cathy Hume, VP Corporate Development & Director

T: 416-868-1079 x 251

E: cathy@chfir.com

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals

LinkedIn: @SokomanMineralsCorp

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Company should be considered highly speculative. This news release contains "forward-looking statements" within the meaning of the applicable Canadian securities legislation that are based on expectations, estimates, assumptions, geological theories, and projections as at the date of this news release. The information in this news release about any information herein that is not a historical fact may be "forward-looking statements." Actual results may differ materially.

Any statement that involves discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (which may, but not always, include phrases such as "anticipates", "plans", "scheduled", "believed" or "intends" or variations of such words and phrases or stating that certain actions, events or results "may" or "could", "would", "might" or "will" be taken to occur or be achieved) including statements regarding the Company's plans with respect to the Company's projects and the timing related thereto, the merits of the Company's projects, the Company's objectives, plans and strategies, the receipt of TSXV final approval for the Offering, the use of proceeds of the Offering, and other matters are not statements of historical fact and may be forward-looking statements and are intended to identify forward-looking statements. Factors that may cause results to vary include delays in obtaining necessary approvals, changes in the market for the Company's securities, results of exploration, loss of title to properties, delays in obtaining permits or access to mineral properties, including as a result of adverse weather, fire or flood, changes to the Tax Act, rejection of expenditures as Qualifying Expenditures, and factors included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof, except as required by law.

Not for distribution to United States newswire services or for dissemination in the United States.

Sokoman Minerals Closes $26 Million "Bought Deal" Private Placement, including Full Exercise of Over-Allotment

St. John’s, NL, October 31, 2025 – Sokoman Minerals Corp. (TSXV: SIC) (OTCQB: SICNF) (“Sokoman” or the “Company”) is pleased to announce that it has closed its previously announced bought deal private placement offering (the "Offering") for aggregate gross proceeds to the Company of $26,221,750. The Offering consisted of:

53,000,000 common shares of the Company (the "Common Shares") at a price of $0.19 per Common Share for aggregate gross proceeds of $10,070,000; and

60,950,000 common shares of the Company (the "FT Shares") that will qualify as "flow-through shares" (within the meaning of subsection 66(15) of the Income Tax Act (Canada) (the "Tax Act"), including 7,950,000 FT Shares issued pursuant to the full exercise of the over-allotment option, at a price of $0.265 per FT Share for aggregate gross proceeds of $16,151,750. The FT Shares were distributed on a charity flow through basis.

Mr. Eric Sprott, through 2176423 Ontario Ltd., a corporation beneficially owned by him, acquired 53,000,000 Common Shares in connection with the Offering.

The net proceeds from the sale of the Common Shares will be used by the Company for property acquisitions as well as working capital and general corporate purposes. The gross proceeds from the sale of the FT Shares will be used to incur "Canadian exploration expenses" (as defined in the Tax Act) that will qualify as "flow-through mining expenditures" within the meaning of the Tax Act (the "Qualifying Expenditures"). The Qualifying Expenditures will be incurred on or before December 31, 2026, and will be renounced by the Company to the initial purchasers of the FT Shares with an effective date no later than December 31, 2025.

The Offering was led by Canaccord Genuity Corp. ("Canaccord"), as lead underwriter and sole bookrunner, and BMO Capital Markets (together with Canaccord, the "Underwriters") pursuant to an underwriting agreement entered into among the Company and the Underwriters. In connection with the Offering, the Company paid the Underwriters a cash commission of $1,073,305 and issued the Underwriters 3,679,105 broker warrants (the "Broker Warrants"). Each Broker Warrant entitles the holder thereof to purchase one common share of the Company (the "Broker Warrant Shares") at an exercise price of $0.19 per Broker Warrant Share for a period of 24 months following the closing of the Offering.

The Offering included participation by a director of the Company for 130,000 Common Shares. Such participation constitutes a "related party transaction" pursuant to Multilateral Instrument 61-101 - Protection of Minority Securityholders in Special Transactions ("MI 61-101"). However, the insider participation is exempt from the formal valuation and minority shareholder approval requirements set forth in MI 61-101 on the basis that the fair market value of the consideration does not exceed 25% of the Company's market capitalization.

The Common Shares and FT Shares issued in the Offering are subject to a four-month hold period under applicable Canadian securities laws.

The Offering remains subject to the final approval of the TSX Venture Exchange (the "TSXV").

The Common Shares and FT Shares have not been registered and will not be registered under the U.S. Securities Act of 1933, as amended, and may not be offered or sold in the United States absent registration or an applicable exemption from the registration requirements. This press release shall not constitute an offer to sell or the solicitation of an offer to buy nor shall there be any sale of the securities in any state in which such offer, solicitation or sale would be unlawful.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is led by an experienced management team and is the dominant explorer along the Valentine Lake Fault zone in Newfoundland, Canada's newest gold district. The Company's primary focus is its 100% owned district-scale Treasure Island Gold Project, along with a portfolio of gold projects, including the district-scale Fleur de Lys Project.

For more information, please contact:

Denis Laviolette, CEO, Executive Chairman, Director

E: denis@sokomanmineralscorp.com

Cathy Hume, VP Corporate Development, Director

T: 416-868-1079 x 251

E: cathy@chfir.com

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals

LinkedIn: @SokomanMineralsCorp

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward-looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

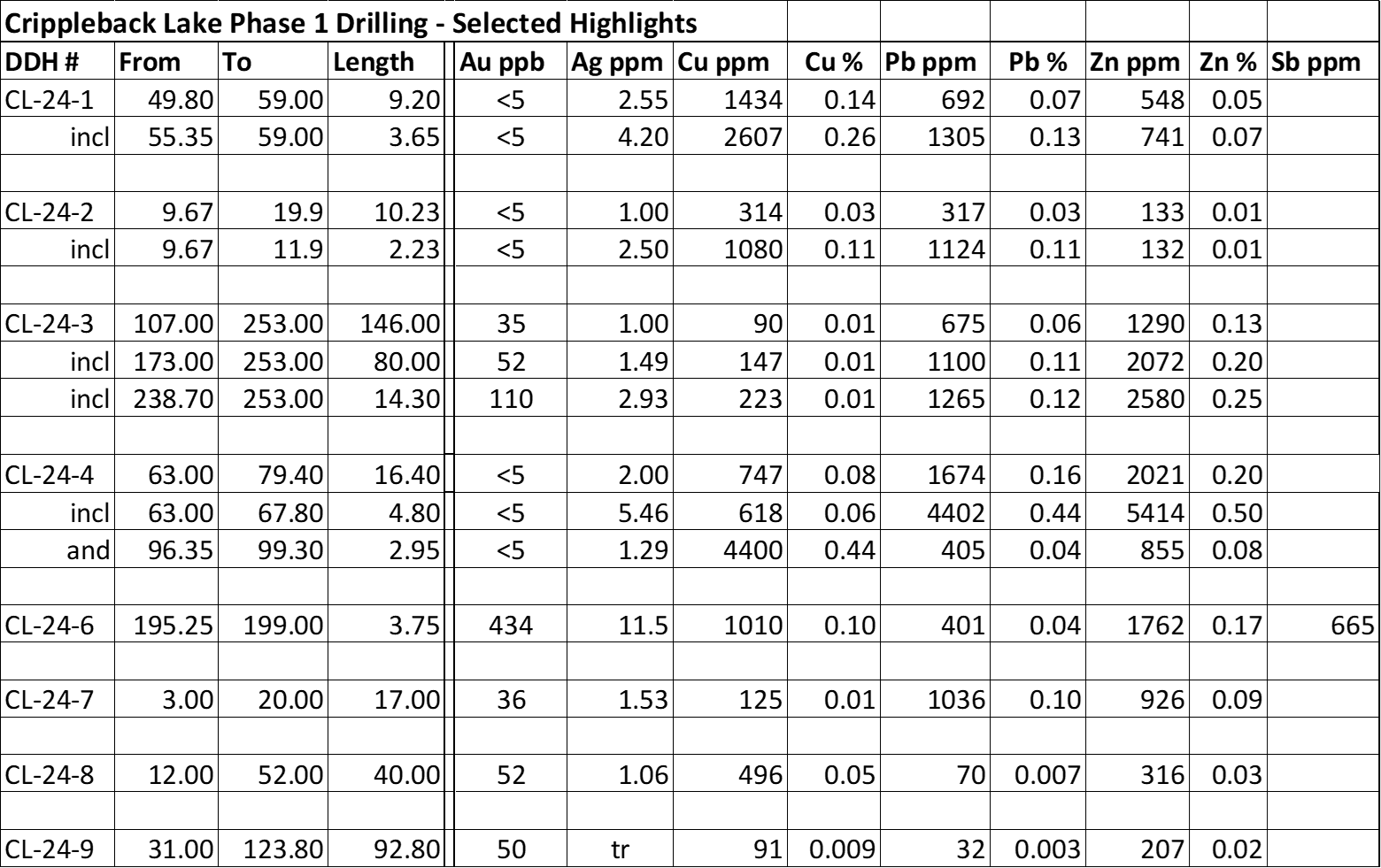

Sokoman Minerals Provides Update on Stony Lake and Keats Properties

St. John’s, NL, October 20, 2025 – Sokoman Minerals Corp. (TSXV: SIC) (OTCQB: SICNF) (“Sokoman” or the “Company”) further to its October 8, 2025 news release the Company is pleased to provide further details regarding the expansion of the Company's holdings along the Valentine Lake Fault.

Sokoman has entered into an agreement with Kevin Keats and 91112 Newfoundland and Labrador Inc. "91112") to acquire a 100% interest in and to 6 mineral licences (the "Keats Property") . In consideration of the Keats Property the Company will, subject to TSX Venture Exchange ("TSXV") approval, make a 1-time cash payment of $50,000 to 91112, issue 2,500,000 common shares to 91112, and grant a 1.5% NSR royalty to 91112 one half of which Sokoman can purchase for $1,500,000.

Further, Sokoman has also entered in an option agreement with K9 Gold Corp. ("K9") and District Copper Corp. ("DCC") for the right to acquire a 100% interest in and to 4 mineral licenses, totalling 257 mining claims located in the Valentine Lake Fault area of Newfoundland (the "Stony Lake Property"). Subject to TSXV approval, and in order to exercise the option for the Stony Lake Property (the "Option"), the Company will issue 1,500,000 common shares to K9, 500,000 common shares to DCC and incur by December 1, 2025 sufficient exploration expenditures to keep the Property in good standing or alternatively make an equivalent cash payment to government authorities. Upon exercise of the Option DCC will cancel any existing royalties on the Property held by it.

UPDATE ON $24 MILLION OFFERING

Further to its October 8, 2025 news release the Company advises that the Underwriters will have the option exercisable, in whole or in part at any time up to 48 hours prior to the closing of the Offering, to purchase up to an additional 7,950,000 FT Shares (not Common Shares as originally stated) at the FT Share issue price for additional gross proceeds of $2,106,750.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company and one of the largest landholders in Newfoundland and Labrador, Canada's emerging gold district. The Company's primary focus is its portfolio of gold projects, including the 100%-owned flagship, advanced-stage Moosehead project (a Fosterville-type orogenic gold deposit), the Crippleback Lake (gold-copper porphyry) project, and the district-scale Fleur de Lys (Dalradian-type orogenic gold) project. The Company entered a strategic alliance with Benton Resources Inc. (TSXV: BEX) through three large-scale joint-venture properties, including Grey River, Golden Hope, and Kepenkeck in Newfoundland. The Golden Hope project was recently spun out as a critical minerals-focused company, Vinland Lithium Inc. (TSXV: VLD), of which Sokoman remains a major shareholder along with Benton Resources Inc., and Australian-based Elevra Lithium Ltd. (ASX: SYA) (NASDAQ: ELVR) (OTCQB: SYAXF), formerly known as Sayona Mining Limited.

For more information, please contact:

Denis Laviolette, CEO, Executive Chairman, Director

E: denis@sokomanmineralscorp.com

Cathy Hume, VP Corporate Development, Director

T: 416-868-1079 x 251

E: cathy@chfir.com

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals

LinkedIn: @SokomanMineralsCorp

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward-looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

Sokoman Minerals Triples Claim Holdings Along 65 km of the Valentine Lake Fault, Building Its District-Scale Treasure Island Project

St. John’s, NL, October 8, 2025 – Sokoman Minerals Corp. (TSXV: SIC) (OTCQB: SICNF) (“Sokoman” or the “Company”) is pleased to announce it has secured the right to acquire mineral licenses covering 41,150 hectares along the Valentine Lake Fault, which also hosts Canada's newest producing gold mine operated by Equinox Gold Corp. The acquisition will position Sokoman as the largest landholder by strike length and area along the highly prospective regional fault system.

Highlights

The Company's mineral license holdings along the Valentine Lake Fault will expand to over 65 km of strike length and an area totalling 58,775 hectares.

This increase more than doubles the prospective strike length while tripling the area of its mineral licenses.

The Valentine Gold Mine, operated by Equinox Gold Corp., started processing ore in August 2025, and with the first Gold pour in Q3 2025, will be Canada's newest large-scale gold mine with an initial mineral resource of 4 million ounces. The 2022 Feasibility Study on the Valentine Gold Mine outlined production of 195,000 ounces of gold per year.

The Valentine Gold Mine is geologically situated along the Valentine Lake Fault zone, a large-scale regional fault structure believed to play an integral role in the formation of the deposit.

Through two separate claim acquisition agreements and staking, the Company will transform its Moosehead and Crippleback claim groups to form the Treasure Island Project.

The Treasure Island Project contains the largest mineral license package and longest strike length along the Valentine Lake Fault and positions Sokoman as the dominant explorer along strike of the Valentine Gold Mine.

The 100% owned Treasure Island Project will be host to the most advanced gold zone outside of the Valentine Gold Mine at the Moosehead Zone, which has over 135,000 m of drilling completed to date, including high-grade highlights of:

70.3 g/t Au over 9.05 m (MH-18-39)

45.0 g/t Au over 11.9 m (MH-18-01)

12.5 g/t Au over 39.6 m (MH-22-463)

69.5 g/t Au over 4.85 m (MH-24-649)

56.6 g/t Au over 5.55 m (MH-21-342)

The district-scale Treasure Island Project covers a similar geological environment as the Moosehead Zone and includes several other known gold showings and occurrences with similar mineralogical characteristics.

Outside of the 2 km strike length of the Moosehead Zone, very limited exploration and drilling has occurred along the remaining 63 km of the Treasure Island Project, which remains open for discovery.

Fig. 1 - Map Showing the Consolidated Mineral Licenses of the Treasure Island Project

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6079/269611_2af29345147e5b94_002full.jpg

"We believe the recent claim acquisitions are fundamentally transforming the Company's exploration strategy to take a district-scale approach while remaining focused on our core mineralized zones at Moosehead. With a dominant position along the Valentine Lake Fault, we believe the Company can apply its Newfoundland expertise to make other high-grade gold discoveries," said Denis Laviolette, Executive Chairman, CEO & Director.

The Company also reports that James Adams, Ph.D., CFA, has stepped down from the Board of Directors of Sokoman but will remain with the Company as a member of the newly formed Advisory Board. The Company wishes to thank James and Colin Bowdidge, Ph.D., for their years of service on the board and welcomes their continued involvement as Advisory Board members.

The Company is also pleased to welcome Kevin Keats as a member of the Advisory Board. Mr. Keats is a successful businessman and entrepreneur, and a member of the renowned Keats prospecting family, which was instrumental in the recognition, through multiple discoveries, of Central Newfoundland as a world-class destination for gold and base metal deposits. The Keats family were awarded the Bill Dennis Prospector of the Year Award in 2007 for their collective contributions to the mineral industry in Newfoundland & Labrador and abroad.

"On behalf of the Company, I thank James and Colin for their service as directors and look forward to working with them and Kevin through our new advisory board," said Tim Froude, P.Geo., President.

In connection with the mineral claim acquisition agreements, and subject to receipt of all required regulatory approval, the Company will issue 4,500,000 common shares and make cash payments totalling $50,000.

Qualified Person

Greg Matheson, P.Geo., VP Exploration for Sokoman, a "Qualified Person" under National Instrument 43-101, has reviewed and approved the scientific and technical information in this press release.

The information provided herein regarding the Valentine Gold Mine is not necessarily indicative of the mineralization on the Treasure Island Project. The Qualified Person has not verified the information concerning the adjacent property, and there is no certainty that the same results or mineralization will be obtained on the Treasure Island Project. This disclaimer is made in compliance with the requirements of National Instrument 43-101.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is led by an experienced management team and is the dominant explorer along the Valentine Lake Fault zone in Newfoundland, Canada's newest gold district. The Company's primary focus is its 100% owned district-scale Treasure Island Gold Project, along with a portfolio of gold projects, including the district-scale Fleur de Lys Project.

For more information, please contact:

Denis Laviolette, Executive Chairman, CEO & Director

E: denis@sokomanmineralscorp.com

Cathy Hume, VP Corporate Development & Director

T: 416-868-1079 x 251

E: cathy@chfir.com

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals

LinkedIn: @SokomanMineralsCorp

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward-looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

Sokoman Minerals Announces $24 Million "Bought Deal" Private Placement of Common Shares Led by Eric Sprott

Not for distribution to United States newswire services or for dissemination in the United States

St. John’s, NL, October 8, 2025 – Sokoman Minerals Corp. (TSXV: SIC) (OTCQB: SICNF) (“Sokoman” or the “Company”) is pleased to announce that it has entered into an agreement pursuant to which Canaccord Genuity Corp., as lead underwriter, on behalf of a syndicate of Underwriters to be formed (collectively, the “ Underwriters ”), in connection with a “ bought deal ” private placement (the “ Offering ”). The Company is also pleased to announce that it has secured the commitment of Eric Sprott, an existing major shareholder, to participate in the Offering. The Offering will consist of:

53,000,000 common shares of the Company (the “ Common Shares ”) at a price of C$0.19 per Common Share (the “ Common Share Offering Price ”) for aggregate gross proceeds of C$10,070,000; and

53,000,000 common shares of the Company (the “ FT Shares ”) that will qualify as “flow-through shares” (within the meaning of subsection 66(15) of the Income Tax Act (Canada) (the “ Tax Act ”) at a price of C$0.265 per FT Share for aggregate gross proceeds of C$14,045,000. The FT Shares are being distributed on a charity flow through basis.

The Underwriters will have the option exercisable, in whole or in part at any time up to 48 hours prior to the closing of the Offering, to purchase up to an additional 7,950,000 Common Shares at the Common Share Issue Price for additional gross proceeds of $1,510,500.

The Company expects to use the net proceeds from the sale of the Common Shares for property acquisitions as well as working capital and general corporate purposes. The gross proceeds from the sale of the FT Shares will be used to incur Qualifying Expenditures (as defined below).

The Company will use an amount equal to the aggregate gross proceeds raised from the issuance of the FT Shares to incur “Canadian exploration expenses” (as defined in the Tax Act) that will qualify as “flow-through mining expenditures” within the meaning of the Tax Act (the “ Qualifying Expenditures ”). The Qualifying Expenditures will be incurred on or before December 31, 2026 and will be renounced by the Company to the initial purchasers of the FT Shares with an effective date no later than December 31, 2025.

In the event that the Company is unable to renounce Qualifying Expenditures in an aggregate amount equal to the gross proceeds raised from the issuance of the FT Shares, with an effective date of no later than December 31, 2025, as described above, and/or the Qualifying Expenditures are otherwise reduced by the Canada Revenue Agency, the Company will, to the extent permitted by the Tax Act, indemnify each subscriber of the FT Shares for the additional taxes payable by such subscriber as a result of the Company’s failure to renounce the full amount of the Qualifying Expenditures or as a result of the reduction.

Insiders of the Company may participate in the Offering. Any participation by Eric Sprott or other insiders would be considered a “related-party transaction” under Multilateral Instrument 61-101, but is expected to be exempt from the formal valuation and minority shareholder approval requirements on the basis that the fair market value of the consideration does not exceed 25% of the Company’s market capitalization. The Offering is expected to close on or about October 29, 2025, or such other date as the Company and the Underwriters may agree and is subject to certain conditions including, but not limited to, the receipt of all necessary regulatory and other approvals including the acceptance of the TSX Venture Exchange.

The Common Shares and FT Shares have not been registered and will not be registered under the U.S. Securities Act of 1933, as amended, and may not be offered or sold in the United States absent registration or an applicable exemption from the registration requirements. This press release shall not constitute an offer to sell or the solicitation of an offer to buy nor shall there be any sale of the securities in any State in which such offer, solicitation or sale would be unlawful.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is led by an experienced management team and is the dominant explorer along the Valentine Lake Fault zone in Newfoundland, Canada's newest gold district. The Company's primary focus is its 100% owned district-scale Treasure Island Gold Project, along with a portfolio of gold projects, including the district-scale Fleur de Lys Project.

For more information, please contact:

Denis Laviolette, Executive Chairman, CEO & Director

E: denis@sokomanmineralscorp.com

Cathy Hume, VP Corporate Development & Director

T: 416-868-1079 x 251

E: cathy@chfir.com

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals

LinkedIn: @SokomanMineralsCorp

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Company should be considered highly speculative. This news release contains forward-looking statements that involve risks and uncertainties. Forward-looking statements in this press release relate to the closing of the Offering and use of proceeds of the Offering. Actual results may differ materially. Factors that may cause results to vary include delays in obtaining necessary approvals, changes in the market for the Company’s securities, results of exploration, loss of title to properties, delays in obtaining permits or access to mineral properties, including as a result of adverse weather, fire or flood, changes to the Income Tax Act, rejection of expenditures as Qualifying Expenditures, and factors included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof, except as required by law.

Sokoman Minerals Appoints New Director, Grants Options

St. John’s, NL, October 2, 2025 – Sokoman Minerals Corp. (TSXV: SIC) (OTCQB: SICNF) (“Sokoman” or the “Company”) is pleased to announce the appointment of Wanda Cutler to its Board of Directors.

Ms. Cutler, Founder and President of Cutler McCarthy Inc., brings over 25 years of expertise in investor relations, capital markets, corporate governance and strategic advisory in the resource sector. Her previous roles and board positions include Chablis Capital Corp., Route 109 Resources, Quebec Precious Metals, Vanstar Mining, Li-FT Power, and Imagine Lithium, as well as Head of Corporate Development of Amex Exploration, and senior IR and advisory roles with Nemaska Lithium, Energy Fuels, Treasury Metals, and Pinetree Capital. She holds a Bachelor of Social Science from the University of Ottawa.

Denis Laviolette, Director, Executive Chairman & CEO of Sokoman, commented, “We are thrilled to welcome Wanda to Sokoman’s Board. Her deep expertise in capital markets, governance, and investor communications, coupled with her extensive network in the resource sector, will add tremendous value as we advance the Moosehead Gold Project and our broader exploration portfolio. Wanda’s track record of building companies and guiding them through critical growth stages aligns perfectly with our vision for Sokoman’s future.”

Wanda Cutler added, “I am honoured to join Sokoman at such an exciting time for the Company. With a strong project portfolio in one of Canada’s most prospective gold districts, Sokoman is well-positioned for growth, and I look forward to working alongside Denis, Tim, and the Board to help unlock the full potential of these assets.”

Further, the Company is granting 6,000,000 stock options to directors and consultants of the Company. The stock options shall vest immediately and are exercisable at $0.14 per common share for a period of five (5) years.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company and one of the largest landholders in Newfoundland and Labrador, Canada's emerging gold district. The Company's primary focus is its portfolio of gold projects, including the 100%-owned flagship, advanced-stage Moosehead project (a Fosterville-type orogenic gold deposit), the Crippleback Lake (gold-copper porphyry) project, and the district-scale Fleur de Lys (Dalradian-type orogenic gold) project. The Company entered a strategic alliance with Benton Resources Inc. (TSXV: BEX) through three large-scale joint-venture properties, including Grey River, Golden Hope, and Kepenkeck in Newfoundland. The Golden Hope project was recently spun out as a critical minerals-focused company, Vinland Lithium Inc. (TSXV: VLD), of which Sokoman remains a major shareholder along with Benton Resources Inc., and Australian-based Elevra Lithium Ltd. (ASX: SYA) (NASDAQ: ELVR) (OTCQB: SYAXF), formerly known as Sayona Mining Limited.

For more information, please contact:

Denis Laviolette, CEO, Executive Chairman, Director

E: denis@sokomanmineralscorp.com

Cathy Hume, VP Corporate Development, Director

T: 416-868-1079 x 251

E: cathy@chfir.com

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals

LinkedIn: @SokomanMineralsCorp

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward-looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

CORRECTION to September 29th News Release: Sokoman Minerals Corp. Announces New Leadership Appointments

St. John’s, NL, September 29, 2025 – Sokoman Minerals Corp. (TSXV: SIC) (OTCQB: SICNF) (“Sokoman” or the “Company”) advises that in the news release titled "Sokoman Minerals Corp. Announces New Leadership Appointments" dated September 29, 2025, the exercise price of the stock options was incorrectly stated as $0.05. The correct exercise price is $0.055 per common share. All other details remain unchanged.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company and one of the largest landholders in Newfoundland and Labrador, Canada's emerging gold district. The Company's primary focus is its portfolio of gold projects, including the 100%-owned flagship, advanced-stage Moosehead project (a Fosterville-type orogenic gold deposit), the Crippleback Lake (gold-copper porphyry) project, and the district-scale Fleur de Lys (Dalradian-type orogenic gold) project. The Company entered a strategic alliance with Benton Resources Inc. (TSXV: BEX) through three large-scale joint-venture properties, including Grey River, Golden Hope, and Kepenkeck in Newfoundland. The Golden Hope project was recently spun out as a critical minerals-focused company, Vinland Lithium Inc. (TSXV: VLD), of which Sokoman remains a major shareholder along with Benton Resources Inc., and Australian-based Elevra Lithium Ltd. (ASX: SYA) (NASDAQ: ELVR) (OTCQB: SYAXF), formerly known as Sayona Mining Limited.

For more information, please contact:

Denis Laviolette, CEO, Executive Chairman, Director

T: 647-992-9837

E: denis@earthlabs.com

Cathy Hume, VP Corporate Development, Director

T: 416-868-1079 x 251

E: cathy@chfir.com

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals

LinkedIn: @SokomanMineralsCorp

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward-looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

Sokoman Minerals Corp. Announces New Leadership Appointments

St. John’s, NL, September 29, 2025 – Sokoman Minerals Corp. (TSXV: SIC) (OTCQB: SICNF) (“Sokoman” or the “Company”) is pleased to announce a series of key leadership appointments to its Board of Directors and executive team, effective September 29, 2025. These appointments strengthen the Company's governance, capital market and operational expertise as it advances its flagship Moosehead Gold Project and other exploration initiatives in Newfoundland and Labrador.

Denis Laviolette has been appointed as Director, Executive Chairman, and CEO. Mr. Laviolette brings more than 20 years of experience in mining, exploration, capital markets, and corporate leadership, with a proven track record of driving strategic growth. He began his career as a production and exploration geologist in some of Canada's major mining camps, including Timmins, Kirkland Lake, and Red Lake, as well as internationally in Norway and Ghana, before moving into capital markets as a mining analyst with Pinetree Capital. He is the Founder and Executive Chairman of EarthLabs Inc. (TSXV: SPOT) (formerly GoldSpot Discoveries Corp.), a technology and investment issuer with more than $50M in assets. Under his leadership, EarthLabs pioneered the use of artificial intelligence for mineral exploration; the brand "Goldspot" team and technology were sold to ALS Limited (ASX: ALQ) in 2022 for ~$30M. EarthLabs has since acquired CEO.CA Technologies Ltd., one of the largest investor platforms with more than 12 million users and expanded into complementary mining media through the acquisition of The Northern Miner Group, publishers of The Northern Miner, Canadian Mining Journal, and MINING.COM. He is also the founder and former President/CEO of New Found Gold Corp (TSXV: NFG) (NYSE: NFGC), where he was instrumental in one of Canada's most significant high-grade gold discoveries at the Queensway Project in Newfoundland. His expertise will guide Sokoman's vision and operational strategy as the Company continues to develop its high-potential mineral projects.

Timothy Froude, P.Geo., has transitioned to the role of President, having previously served as President and CEO of Sokoman. Mr. Froude brings more than 35 years of mineral exploration experience. He began his career with Inco Ltd., spending nearly a decade on projects in North America and overseas, and was part of the team that discovered the Bobby's Pond massive sulphide deposit in central Newfoundland. He is also credited with the discovery of the Valentine Lake gold deposit in central Newfoundland, Canada's newest gold mine, recently commissioned by Equinox Gold (TSX: EQX) (NYSE American: EQX). Throughout his career, Mr. Froude has held senior roles with Cornerstone Capital Resources Inc., Crosshair Exploration & Mining Corp, and Golden Dory Resources Ltd., and served as Executive Director of the Newfoundland and Labrador Chamber of Mineral Resources (now Mining NL). A graduate of Memorial University of Newfoundland, his deep knowledge of Sokoman's operations and exploration portfolio will continue to drive the Company's commitment to responsible and sustainable exploration.

Gary Nassif, P.Geo., has been appointed as a Director. Mr. Nassif is a professional geologist with more than 30 years of experience in gold, base-metal, and diamond exploration across Canada, the United States, and sub-Saharan Africa. He most recently served as Senior Vice President of LODE Gold Resources Inc. (TSXV: LOD) (formerly Stratabound), and also Jerritt Canyon Gold, previously owned by Sprott Mining Inc. and acquired by First Majestic Silver Corp. Mr. Nassif is currently President and CEO of Argentum Silver Corp. (TSXV: ASL), a Director of Kirkland Lake Discoveries (TSXV: KLDC), and a Director of Inventus Mining (TSXV: IVS). His previous roles include Manager of Exploration Services for Kerr Mines Inc., Northern Gold Mining Inc., and Trelawney Mining & Exploration Inc., prior to its $608 million acquisition by IAMGOLD (TSX: IMG) (NYSE: IAG) in 2012. He holds an M.Sc. in Geology from McGill University, a B.Sc. in Geology from Concordia University, and a Certificate in Mining Law from Osgoode Hall. His appointment will reinforce the renewed capital markets focus for the Company, along with a wide array of geological expertise.

Greg Matheson, P.Geo., is filling a vacancy left by the departure of Dan Lee and has been appointed as VP Exploration of the Company. Mr. Matheson is a professional geologist and a Qualified Person under National Instrument 43-101, with more than 15 years of experience managing exploration programs from grassroots to advanced stages. He recently served as Chief Operating Officer of New Found Gold Corp., having led the Queensway Project in Newfoundland from its discovery through to initiation of its maiden resource of more than two million ounces. Previously, he held senior roles as Exploration Manager of Northern Gold Mining Inc. and Senior Project Manager with Osisko Mining Inc. Mr. Matheson was also responsible for the discovery and delineation of the Garrison Gold project in northeastern Ontario, from early exploration through trial production and defining resources of more than two million ounces. His technical expertise and operational experience will enhance Sokoman's exploration programs, ensuring technical compliance and advancing the Company's strategic objectives.

In connection with these changes, Timothy Froude and Colin Bowdidge, Ph.D., have stepped down as Directors. The Board of Directors now consists of Peter Dimmell, P.Geo., Cathy Hume, and James Adams, Ph.D., CFA, alongside newly appointed directors Denis Laviolette and Gary Nassif. Gord Fretwell will continue to serve as Sokoman's Corporate Secretary and Legal Counsel.

In recognition of Mr. Laviolette joining the Company as a Director, Executive Chairman and CEO, and Mr. Matheson joining as VP Exploration, the Company has granted to each of Mr. Laviolette and Mr. Matheson 11,000,000 stock options, for an aggregate of 22,000,000 stock options (the "Stock Options"), in accordance with the Company's stock option plan. The Stock Options will vest immediately and will be exercisable at $0.05 per common share for a period of three (3) years.

"We are excited to welcome Gary Nassif and Greg Matheson to their new roles, and I am honoured to assume the role of Executive Chairman and CEO," said Denis Laviolette. "On behalf of the Company, I thank Colin Bowdidge and Tim Froude for their service as Directors and acknowledge Tim's continued leadership as President. Together, this strengthened leadership team brings a wealth of expertise in exploration, governance, and investor relations, positioning Sokoman for sustained growth and success as we advance our exploration initiatives."

"I couldn't be more thrilled with the evolution of Sokoman's management team and board. Our shareholders know my true passion lies in the field-making discoveries and advancing them into real value, and these changes position us perfectly to deliver on that vision," commented Tim Froude.

"I am incredibly excited about the opportunities that lie before Sokoman. Tim and the team have made some exceptional high-grade discoveries at the Moosehead project during the past few years, and I look forward to accelerating that progress. Newfoundland and Labrador is one of the best jurisdictions in the world for gold exploration, and I am delighted to once again be exploring in the province," said Greg Matheson.

Sokoman Minerals Corp. remains committed to responsible exploration and sustainable growth, with these appointments reinforcing the Company's dedication to building a dynamic and experienced leadership team.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company and one of the largest landholders in Newfoundland and Labrador, Canada's emerging gold district. The Company's primary focus is its portfolio of gold projects, including the 100%-owned flagship, advanced-stage Moosehead project (a Fosterville-type orogenic gold deposit), the Crippleback Lake (gold-copper porphyry) project, and the district-scale Fleur de Lys (Dalradian-type orogenic gold) project. The Company entered a strategic alliance with Benton Resources Inc. (TSXV: BEX) through three large-scale joint-venture properties, including Grey River, Golden Hope, and Kepenkeck in Newfoundland. The Golden Hope project was recently spun out as a critical minerals-focused company, Vinland Lithium Inc. (TSXV: VLD), of which Sokoman remains a major shareholder along with Benton Resources Inc., and Australian-based Elevra Lithium Ltd. (ASX: SYA) (NASDAQ: ELVR) (OTCQB: SYAXF), formerly known as Sayona Mining Limited.

For more information, please contact:

Denis Laviolette, CEO, Executive Chairman, Director

T: 647-992-9837

E: denis@earthlabs.com

Cathy Hume, VP Corporate Development, Director

T: 416-868-1079 x 251

E: cathy@chfir.com

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals

LinkedIn: @SokomanMineralsCorp

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward-looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

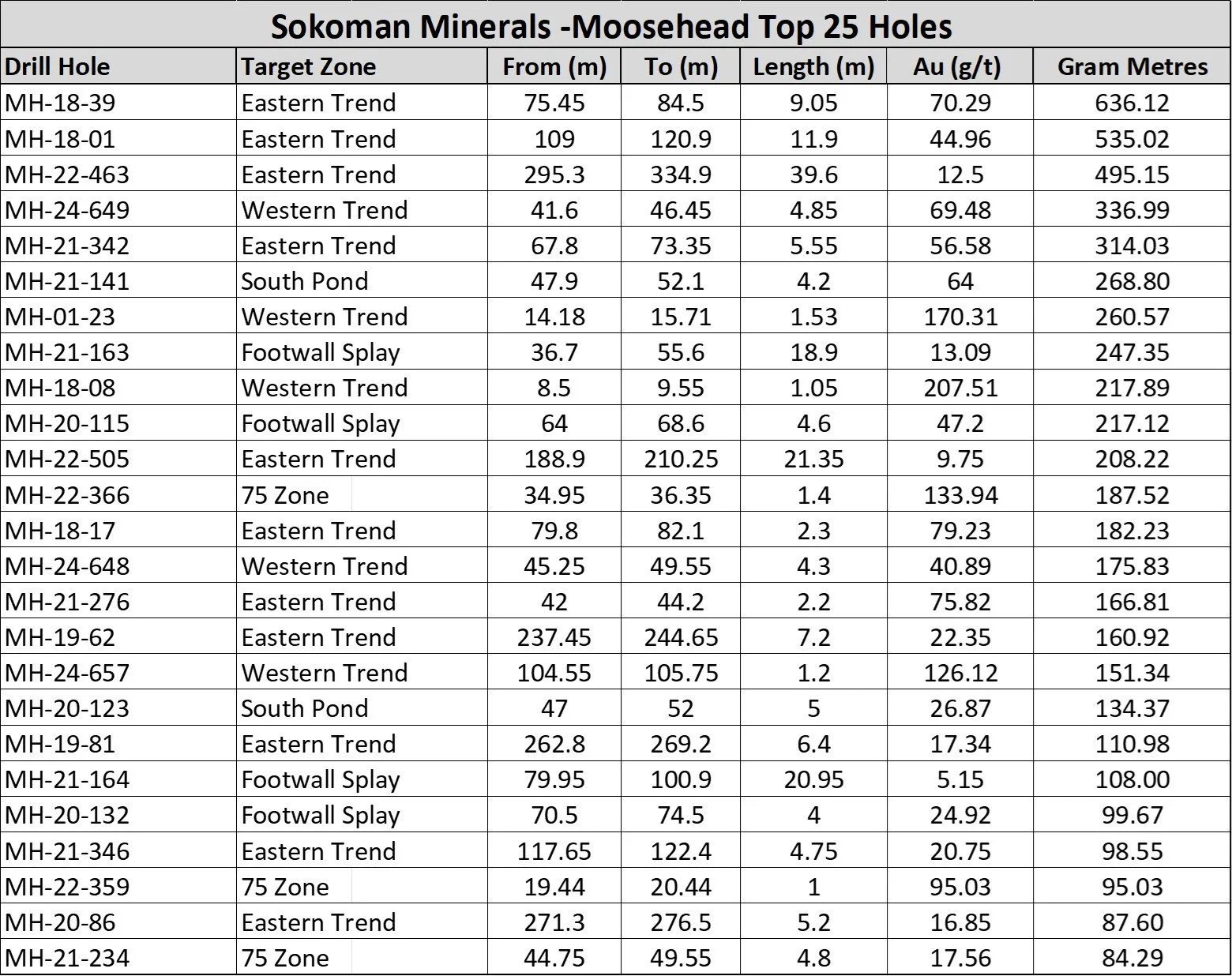

Sokoman to Resume Drilling at Moosehead Gold Project

Program to start with a series of deep (1,000 m) holes

St. John’s, NL, September 12, 2025 – Sokoman Minerals Corp. (TSXV: SIC) (OTCQB: SICNF) (“Sokoman” or the “Company”) is pleased to announce that diamond drilling will resume at the 100%-owned Moosehead Gold Project in central Newfoundland. The initial focus will be a series of deep, 1,000 m depth, downhole drill holes testing the Eastern Trend and Western Trend gold zones for depth extensions, as well as testing for undiscovered parallel zones. Since 2018, a total of 135,325 m of core in 672 drill holes, across the property, have resulted in the definition of five significant zones of gold mineralization and several smaller, less defined zones, with most remaining open for expansion. All the main gold zones have high-grade intersections of at least 100-gram metres of gold to a maximum of 636.12-gram metres from MH-18-39. Please see the table of Moosehead’s Top 25 Holes below.

Timothy Froude, P.Geo., President and CEO, states, “We are extremely excited to be back drilling at Moosehead, given the significance of the deep holes and the impact they could have on the mineralization on the property. Drilling to date has focused on the near surface, to an average depth of about 300 m vertically, where we have been extremely successful in defining high-grade mineralization in five previously unknown zones. The time is right to go deeper than we have in the past, to downhole depths of 1,000 m, and armed with the knowledge we have gained over the past few years, hopefully locating continuous high-grade zones at depth. We expect to be on site in early October and anticipate a four- to five-week timeline to complete drilling.”

Deep Drilling Program